How Maryland Residents Can Refinance Their Auto Loan in 2025

Table of Contents

- Smart Strategies for Saving Money on Your Car Loan This Year

- What Does It Mean to Refinance an Auto Loan?

- Why 2025 Is a Good Year for Maryland Residents to Refinance

- 1. Interest Rates Are Easing

- 2. Vehicle Values Are Strong

- 3. New FinTech Tools Simplify Refinancing

- 4. Lenders Are Competing for Local Borrowers

- Top Benefits of Refinancing Your Auto Loan

- 1. Lower Monthly Payments

- 2. Reduce Total Interest Paid

- 3. Shorten or Extend Your Term

- 4. Improve Your Cash Flow

- 5. Remove a Co-Signer

- 6. Consolidate Multiple Auto Debts

- When Should Maryland Residents Refinance Their Auto Loan?

- The Refinancing Process: Step-by-Step for Maryland Drivers

- Step 1: Review Your Current Loan

- Step 2: Evaluate Your Vehicle’s Value

- Step 3: Shop Around for Offers

- Step 4: Submit a Refinance Application

- Step 5: Choose the Best Terms

- Step 6: Finalize and Enjoy Lower Payments

- Documents You’ll Need to Refinance Your Auto Loan

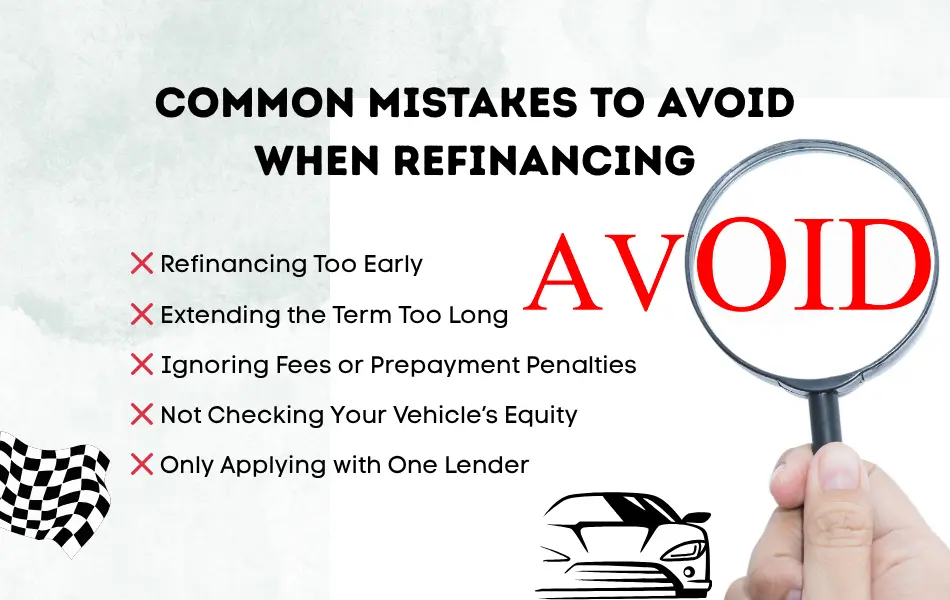

- Common Mistakes to Avoid When Refinancing

- ❌ Refinancing Too Early

- ❌ Extending the Term Too Long

- ❌ Ignoring Fees or Prepayment Penalties

- ❌ Not Checking Your Vehicle’s Equity

- ❌ Only Applying with One Lender

- How Refinancing Affects Your Credit

- Local Lenders and Credit Unions That Serve Maryland Drivers

- FAQs: Auto Loan Refinancing in Maryland

- Q: How soon can I refinance my car loan after purchase?

- Q: Does refinancing cost money?

- Q: Can I refinance if I still owe a lot?

- Q: Can I refinance an older vehicle?

- Q: Can refinancing help if I’m behind on payments?

- Refinance, Save, and Drive Smarter in 2025

- Take the First Step Today

Smart Strategies for Saving Money on Your Car Loan This Year

If you live in Maryland or the Washington DC area and you’re paying too much for your car each month, 2025 could be the perfect year to refinance your auto loan. Between shifting interest rates, new lender options, and improved online refinancing tools, there’s never been a better time for Maryland residents to refinance their auto loans and put real money back in their pockets.

At Bumble Auto, a trusted used car dealership in Elkridge, Maryland, we’ve helped hundreds of drivers across Columbia, Ellicott City, and the DMV region find better auto financing options. Whether you bought your car recently or a few years ago, refinancing can help you lower your interest rate, reduce your monthly payments, or even pay off your vehicle sooner.

In this guide, we’ll cover everything you need to know about auto loan refinancing in Maryland for 2025 — how it works, when to refinance, how to qualify, and how to avoid common mistakes.

Let’s dive in and help you make your next financial move your smartest one yet.

What Does It Mean to Refinance an Auto Loan?

When you refinance an auto loan, you’re replacing your current car loan with a new one — ideally with better terms. The new loan pays off your existing balance, and you begin making payments to the new lender under the updated agreement.

In simple terms:

- You refinance to get a lower interest rate

- You restructure your loan to have more manageable payments

- Or you shorten your term to pay off your car faster and save on interest

For Maryland drivers who financed their vehicle a year or two ago — especially when rates were higher — refinancing in 2025 could mean significant monthly savings.

Why 2025 Is a Good Year for Maryland Residents to Refinance

After a few years of fluctuating interest rates and inflation, 2025 is shaping up to be a year of stability and gradual rate normalization. Many of our readers ask if they should buy a car now or wait until 2026—but for refinancing, the best time could be now. That’s good news for borrowers across Maryland and the Washington DC area.

Here’s why now may be the ideal time to refinance your auto loan:

1. Interest Rates Are Easing

Many lenders are offering competitive rates again as the economy stabilizes. Refinancing could lower your rate by 1–3%, depending on your credit score and current loan terms.

2. Vehicle Values Are Strong

Used car values remain relatively high, especially in markets like Elkridge, Columbia, and Ellicott City, where reliable used vehicles are in constant demand. This means your car likely still has enough equity to qualify for refinancing.

3. New FinTech Tools Simplify Refinancing

Online applications and instant pre-approvals make the process faster and easier than ever — often with decisions in under 24 hours.

4. Lenders Are Competing for Local Borrowers

Local credit unions and regional banks across Maryland and DC are actively offering promotional refinancing programs to attract borrowers — including cash-back offers, no-fee refinancing, and flexible payment plans.

At Bumble Auto, we work with trusted local lenders to help customers find these offers and save money without the stress.

Top Benefits of Refinancing Your Auto Loan

1. Lower Monthly Payments

The most common reason for refinancing is to reduce monthly payments. If you qualify for a lower interest rate, your payment could drop by $50 to $150 per month, depending on your balance and loan term.

2. Reduce Total Interest Paid

Even a small rate drop can save thousands over the life of your loan. For example, cutting your rate from 9% to 6% on a $20,000 balance could save you over $1,500 in interest. According to our car finance definition guide, even minor adjustments in terms can lead to significant savings.

3. Shorten or Extend Your Term

You can refinance to shorten your term and pay off your car sooner, or extend it to make payments more manageable.

4. Improve Your Cash Flow

If your budget’s tight, refinancing gives you breathing room — especially if you’ve taken on new expenses or your income has changed.

5. Remove a Co-Signer

If your credit has improved since buying your car, you can refinance in your own name and remove a co-signer.

6. Consolidate Multiple Auto Debts

In some cases, refinancing can roll in other small vehicle-related debts, making payments simpler and potentially cheaper overall.

When Should Maryland Residents Refinance Their Auto Loan?

Timing matters. Here are the best scenarios when refinancing makes sense:

- Interest rates have dropped since you got your original loan

- Your credit score has improved (especially if you’ve paid on time for 12+ months)

- Your vehicle is still worth more than you owe

- Your current loan has a high rate or bad terms

- You financed through a dealership at a higher markup

- You need to lower monthly payments to balance your budget

If several of these apply, it’s time to explore refinancing options at Bumble Auto. Wondering if your credit qualifies? Our used car interest loan rates guide can help you benchmark your rate. Our finance team can review your current loan and quickly determine if refinancing will save you money.

The Refinancing Process: Step-by-Step for Maryland Drivers

At Bumble Auto, we guide local customers through every step of refinancing — making it simple, transparent, and stress-free. Here’s what the process typically looks like:.

Step 1: Review Your Current Loan

Start by gathering details:

- Current lender

- Loan balance

- Interest rate and monthly payment

- Remaining term

You’ll also want to check your credit score to see where you stand

Step 2: Evaluate Your Vehicle’s Value

Your car’s value plays a big role in refinancing approval. Lenders usually want the car to be worth more than the remaining loan balance (positive equity).

Step 3: Shop Around for Offers

Compare multiple lenders — including local Maryland banks, credit unions, and online lenders. Bumble Auto works with a network of trusted lenders and can help you find the best offer based on your credit and vehicle.

Step 4: Submit a Refinance Application

You’ll provide basic information like income, employment, and your current loan details. Check out our article on how to get prequalified for a car loan to boost your approval odds. Many lenders now offer soft credit checks for pre-qualification, so it won’t affect your score.

Step 5: Choose the Best Terms

Once approved, review loan terms carefully — including rate, term length, and any fees. Make sure the total savings are worth it.

Step 6: Finalize and Enjoy Lower Payments

Your new lender pays off your old loan directly. You start making payments under your new agreement — often with your first payment due in 30 days or more.

Documents You’ll Need to Refinance Your Auto Loan

Before you apply, gather the following:

- Driver’s license or government ID

- Proof of income (pay stubs or tax returns)

- Vehicle registration

- Proof of insurance

- Current loan statement

- Vehicle Identification Number (VIN)

Having these ready speeds up approval — many Maryland lenders can finalize your refinance within 48–72 hours.

Common Mistakes to Avoid When Refinancing

Refinancing can be a fantastic tool, but there are pitfalls to watch out for. Avoid these common mistakes:

❌ Refinancing Too Early

Wait at least six months to one year after your original purchase. That’s when your payment history and credit improvement have the biggest impact.

❌ Extending the Term Too Long

A longer term lowers payments but increases total interest paid. Balance short-term savings with long-term costs.

❌ Ignoring Fees or Prepayment Penalties

Always read the fine print. Some lenders charge small fees that can offset savings. One of the most overlooked mistakes? Failing to evaluate a used car dealer before refinancing or purchasing again.

❌ Not Checking Your Vehicle’s Equity

If your car’s value has dropped below what you owe (negative equity), you may not qualify or may get less favorable terms.

❌ Only Applying with One Lender

Shop around! Bumble Auto’s financing network lets you compare multiple offers to ensure you’re getting the best deal.

How Refinancing Affects Your Credit

A refinance typically causes a temporary, small dip in your credit score due to the lender’s hard inquiry. However, your score often rebounds quickly—and may even improve—after a few months of on-time payments at a lower debt ratio.

To minimize impact:

- Submit all applications within a 14-day window (they count as one inquiry)

- Keep your old account open until the new one is fully processed

- Maintain all other credit payments on time

Within six months, many borrowers see a net credit improvement after refinancing responsibly.

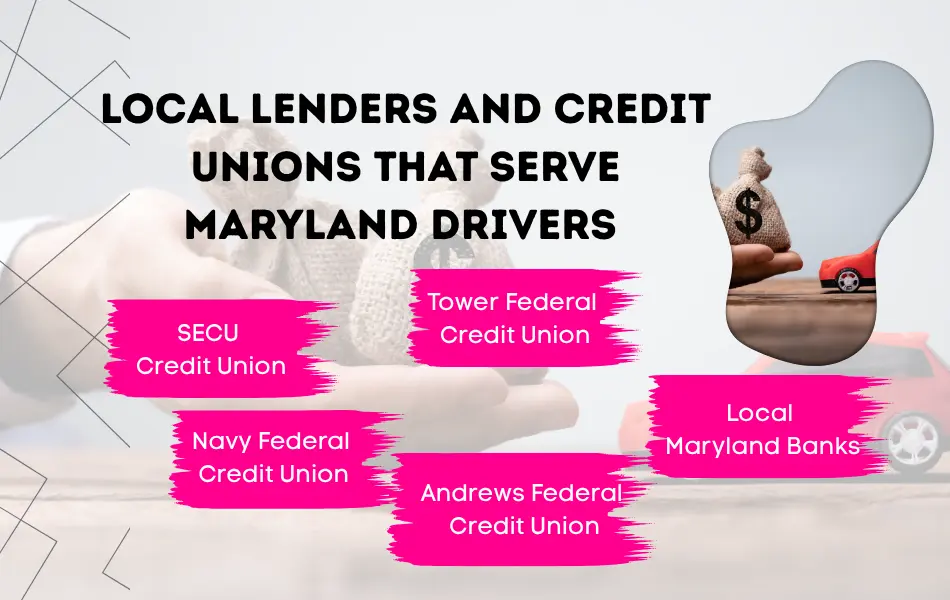

Local Lenders and Credit Unions That Serve Maryland Drivers

When it comes to auto refinancing, local lenders often beat national ones on rates and customer service. Here are some popular choices for Maryland residents:

- SECU Credit Union – Competitive rates and great for members with steady employment

- Tower Federal Credit Union – Excellent for Elkridge, Columbia, and Howard County borrowers

- Navy Federal Credit Union – Ideal for military members and families in the DC area

- Andrews Federal Credit Union – Serves both Maryland and DC with easy online applications

- Local Maryland Banks – Many offer special auto refinance promotions in 2025

FAQs: Auto Loan Refinancing in Maryland

Q: How soon can I refinance my car loan after purchase?

You can usually refinance after 6 months or once you’ve made consistent payments that improve your credit profile.

Q: Does refinancing cost money?

Some lenders charge small fees ($50–$100), but many local credit unions offer no-fee refinancing promotions in 2025.

Q: Can I refinance if I still owe a lot?

Yes. As long as your vehicle has positive equity or sufficient value, you can refinance the balance.

Q: Can I refinance an older vehicle?

Most lenders refinance vehicles less than 10 years old or with under 120,000 miles — but Bumble Auto works with flexible partners who sometimes make exceptions.

Q: Can refinancing help if I’m behind on payments?

Possibly — some lenders offer programs for borrowers in hardship situations. Bumble Auto can review your situation confidentially and recommend the best next steps.

Refinance, Save, and Drive Smarter in 2025

Refinancing your auto loan isn’t just about saving a few dollars each month — it’s about taking control of your finances, improving your credit, and driving with peace of mind.

For Maryland residents in Elkridge, Columbia, Ellicott City, and the Washington DC area, 2025 is the ideal time to explore your options. With the right guidance and lender connections, you could save hundreds — even thousands — this year alone.

At Bumble Auto, we make the process simple, transparent, and local. Our finance specialists help you compare offers, secure better rates, and handle every step with care.

Take the First Step Today

If you’re wondering whether refinancing makes sense for you, there’s no better way to find out than by speaking with a local expert.

👉 Contact Bumble Auto today to schedule a free auto finance consultation — or visit our dealership in Elkridge, Maryland, just minutes from Columbia and Ellicott City.

Our friendly team will review your loan, estimate your potential savings, and connect you with the best refinance options available in 2025.

👉 Ready to refinance? Speak with a trusted expert at Bumble Auto or read our complete pros and cons of refinancing a car loan before you decide.